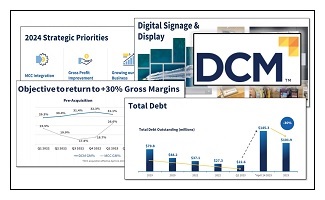

NEW UPDATE REPORT – DCM – Record Revenue & EBITDA Growth Highlight MCC Acquisition Synergies and Improving Margins

We have written a 17-page Update Report on DATA Communications Management (DCM) after it released Q4/2023 and 2023 financial results. DCM is a Canadian-based communications and marketing solutions provider. Revenue increased to $130.0 million in Q4/2023, up 77.9% from Q4/2022, and in-line with our estimate of $131.0 million. For the full year, Revenue hit $447.7 million, up 63.5% from 2022, and in-line with our estimate of $448.8 million. The Adjusted EBITDA for 2023 was $53.4 million, a 30.3% increase from the previous year. The Revenue and EBITDA growth were mainly attributable to the acquisition of Moore Canada Corporation, which closed in Q2/2023. The report provides an overview of DCM‘s financial results, strategic directions for 2024, and our financial estimates and target price calculations. [more]