eResearch | In a March 18, 2020 article, Keith Richards of ValueTrend looked at the last two stock market crashes to see if he can discern a probable next move in today’s frightened stock market environment.

9/11 and the Tech Bubble

“Two for the price of one”. The crash that occurred in 2001 (see chart below) was characterized by a tech sector that was highly overbought, and exacerbated by the September 11 terrorist incidents.

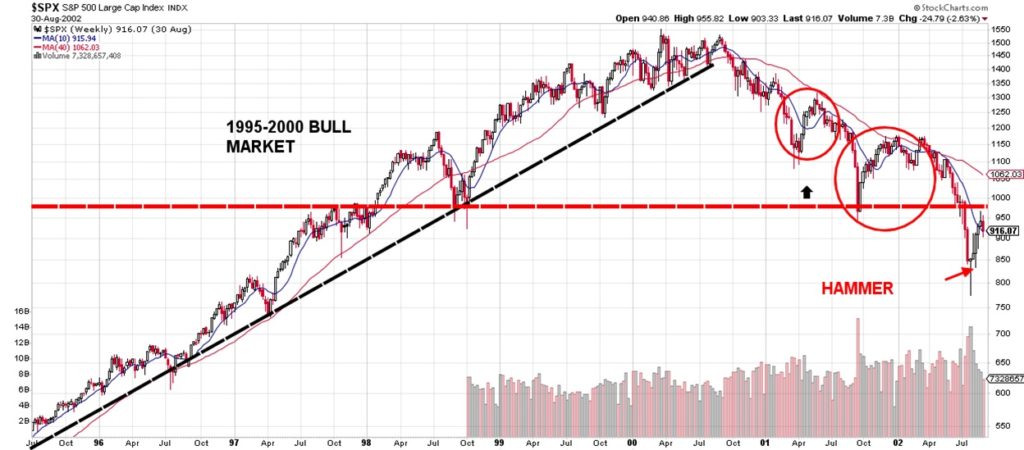

Chart 1 (SPX for 1995-2002): 2001 Stock Market Crash

As the chart above shows, the market peaked at the end of March 2000. Two attempts were made in July-August to take out that all-time high but both failed. The down-draft bottomed, temporarily, one year later at the end of March 2001 (first circle). That was followed by a brief rally before the 9/11-induced plunge that led to another brief rally (second circle) that preceded another significant plunge. The dotted red horizontal line extends from the 1998 “Asian contagion” sell-off. This long-term support line held in its first test in September 2001 but was totally overcome in the next down-draft.

Banking Crash; Oil Crash

Another “two for the price of one”. The crash that occurred in 2008-2009 featured the financial recession and the end of the oil bubble.

Chart 2 (SPX for 2002-2009): Banking/Financial Collapse

The banking/financial collapse was triggered by the Lehman bankruptcy and the bailing out of several major financial institutions, e.g., Merrill Lynch.

The SPX reached a top in September 2007 and then it was downhill almost all of the way until the market bottom in March 2009 that was the head of a “Head & Shoulders” bottoming pattern. After that, the Great Bull Market began.

Chart 3 (WTIC for July/2008-June/2009): Huge Oil Price Decline

The rising price of oil until mid-2008 was based on peak oil, where supply could not keep up with burgeoning demand. The reality was different. The oil price meltdown went from US$145/barrel all the way to US$35/barrel, a 76% decline!

COVID-19; Oil Crash

Yet another “two for the price of one”.

The current stock market crash was set up by a greatly over-extended group of market indexes that had reached all-time highs. All that was needed was a catalyst. Coronavirus enters the picture and the site is not pretty.

The proliferation of the coronavirus throughout the world at such an alarming rate has brought home the stark realization that global economies are going to retrench significantly over the ensuing quarters. World economic growth is going to be negative, highly negative, for months to come. Corporate earnings growth will fall precipitously. Ergo, the stock market debacle we are now experiencing.

As the chart below shows, the red horizontal support line that extends from the December 2018 lows sits (on this chart as of March 18) at 2351.

Keith Richards states: “On the chart below, I have noted that, so long as 2350 is held by the SPX in the next few days, we will get a tradable rally.”

Chart 4 (SPX for 2016-2020 {Current}): Greatest Stock Market Downdraft in History

Mr. Richards goes on to conclude: “If the SPX holds 2350 for the next week, ValueTrend will step in for a tradable rally. It would not surprise me to see 15% or more upside – possibly back to that 2600-2700 area of prior support. Wait before acting. This level must hold. Thereafter, I would be surprised if we didn’t have a final washout, based on prior patterns. But that washout will not likely last long. I am looking for a lifetime opportunity to trade that final washout for massive profits. But this is now, and the best strategy for our way of doing things is to play a rally after evidence of 2350 holding, then see what happens.”

| eResearch Comment: The March 19 closing of the SPX was 2408 and on March 20, it fell to 2304, about 2% below his support level. In determining a support level, we use a band of 3%. This implies a support level that ranges between 2350 and 2280. So, we are still within that band. However, our 3% band is arbitrary and we advise caution. We adhere to Mr. Richard’s statement: “Wait before acting!” We think that there is likely more to play out here. |

ValueTrend Article

You can read the entire ValueTrend article here: Battle Plan

//